Are you in the market for your first home and need a mortgage broker’s help in getting a home loan

When most people think of mortgages, they think of going directly to banks. But mortgage brokers can be a good, if not a better resource when looking for a home loan product. Having a qualified and expert finance broker on board who is knowledgeable about the mortgage industry is key to obtaining the right mortgage for you. So keep reading to know how to find the best mortgage broker to work with.

What is a mortgage broker? And what does they do?

A mortgage broker is a professional who helps borrowers find and secure home loans. They typically work with a variety of lenders, which gives them the ability to find you the best loan product for your needs — perhaps a better deal on your mortgage than you could on your own. A finance broker NSW is licensed to work with borrowers and lenders in the mortgage market. They’re also well-versed in the latest mortgage products and rates, so they can help you get the best deal possible.

How does a mortgage broker get paid?

So who pays the mortgage broker?

Mortgage brokers, or finance brokers as they’re also called, are typically paid a commission by the lender when a loan is originated, not the borrower. The commission varies, but it’s generally a percentage of the loan amount. So, they get a little bit of money every time someone takes out a mortgage.

A finance broker works for the borrower to find the best loan deal from a variety of lenders. The borrower generally pays nothing extra for using a mortgage broker.

Why use a mortgage broker?

A finance broker specialist receives commissions from lenders for putting borrowers into loans, so they have an incentive to find the best product for you. They also have access to a wide range of products from different lenders, which gives them a lot of flexibility in finding you the right loan.

In addition, they operate under the Best Interest Duty statutory obligation, which means that they are legally bound to work in the best interest of consumers.

How to find a good mortgage broker

When it comes to finding a mortgage broker Australia has lots of them around, so this homework is not going to be a walk in the park — but it is definitely worth the effort.

For tips on how to choose a mortgage broker, here are the things you can look for:

1. Experience and expertise

Your mortgage broker should be up-to-date on current lending rules and regulations. They can tap on their wealth of experience to understand the ebbs and flows in the property market, as well as explain the different types of mortgages available to you (i.e., finance solutions for first home buyers, investors, commercial borrowers, etc).

You also shouldn’t fret on knowing what to ask a mortgage broker as they should be available to answer any questions or concerns (no matter how trivial or ridiculous they seem to you) you may have throughout the process.

2. Credentials / qualifications

Check to see if they are licensed by the state in which you live. Note that each state has different requirements. You could look for the following credentials:

- Certificate IV in Finance and Mortgage Broking as stipulated by the Australian Securities and Investments Commission’s Regulatory Guide 206 (ASIC RG 206)

- Australian Credit Licence (ACL) – obtained through the ASIC

- Associations with Mortgage and Finance Association of Australia (MFAA) or Finance Brokers Association of Australia (FBAA)

3. Network

A good mortgage broker must have a vast network of lenders that they can connect borrowers with. He/She will first assess the borrower’s needs and then match them with a lender who can provide the best terms.

Stryve Finance offers a wide range of lending products across a panel of over 30 banks. We negotiate between various lenders on your behalf to obtain competitive rates, fees and terms.

4. Good reviews

Ask around for recommendations. Friends, family, and colleagues are all good sources of information. Another option is to check online reviews.

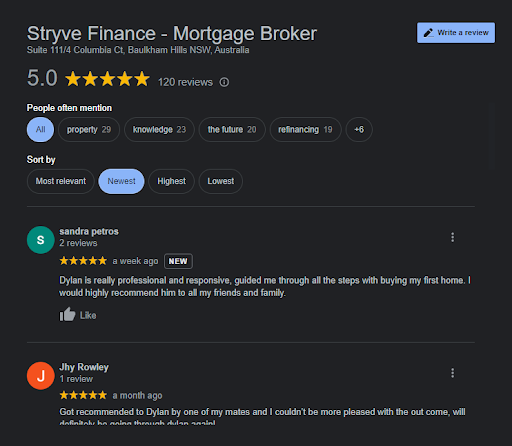

A mortgage broker with good reviews will have a proven track record of providing excellent service and will be able to offer you peace of mind that you are in good hands. To illustrate, you can check out the belowscreenshot of our 100+ 5-star Google reviews from our past clients.

Stryve Finance: your first choice for mortgage broker in Australia

At Stryve Finance, we are your first choice for mortgage brokers in Australia. We work with our clients to find the best possible home loan products and rates available on the market. Our team of experts have years of experience in the industry and can help you find a loan that suits your needs.

Contact us today to learn more about our services or to work with one of our mortgage brokers!