Directory on all NSW First Home Buyer Grants 2025

First home buyers in New South Wales can access various grants and schemes based on their property's price and location—all aimed at helping them enter the market sooner. This guide explains your options so you can make informed decisions.Get started on your homeownership journey today with this handy directory

We compare your rates with 50+ lenders

Who Is Eligible?

Many first home buyers already meet the criteria. Use this checklist.

Basic Checklist (FHOG and most schemes)

At least 18 years old

Australian citizen or permanent resident

First time property owner in Australia

Plan to live in the home (move in within 12 months, stay at least 6 months)

Buying or building a new home:

- Valued up to $600 k (new build or substantially renovated)

- Land plus build valued up to $750 k

Not Eligible If

You or a partner have owned residential property before

You have already received a First Home Owner Grant in Australia

The purchase is for investment

How to Apply for the FHOG

Follow these simple steps to apply for the First Home Owner Grant (FHOG). From checking your eligibility to receiving funds at settlement, this guide walks you through the full application process to help you access government support with confidence.Discover your options in two minutes

Confirm eligibility

Check if you're eligible based on factors like property type, value caps, and your residency status.Each state has different rules. Visit firsthome.gov.au for details.

Choose a lender or broker

Work with a lender or mortgage broker who can help you complete and lodge the FHOG forms. Stryve offers this service at no cost.

Sign your contract

You must have a signed contract to purchase or build your first home before submitting your application.

Submit the application

Lodge your application through your lender or directly to Revenue NSW. Make sure to include all supporting documents.

Wait for approval

If approved, FHOG funds are provided at settlement for completed homes or at the first draw stage for construction.

How Much Can You Get From the FHOG?

(Based on Purchase Type)

New home

Value Cap

Up to $600.000

Grant

$10.000

Eligible

Land and build

Value Cap

Up to $750.000 total

Grant

$10.000

Eligible

Existing home

Value Cap

Any value

Grant

$0

Eligible

Note: Use the grant to boost your deposit, offset build costs, lower your loan or cover fees.

_OA48DgM87%2Fhappy-couple-buying-their-new-home-and-receiving-keys-from-real-estate-agent.jpg%3Ftr%3Dw-auto%2Cdpr-4%2Cq-70&w=3840&q=75)

Quick Facts.

Set that dream project in motion with the best finance broker for your circumstances

- Up to $10.000 cash boost (FHOG)

- Stamp duty savings on homes up to $800k

- Buy with 5 per cent deposit under select guarantees

- Move in within 12 months and stay 6 months (FHOG rule, updated 1 July 2023)

- Free tools to check what you qualify for in minutes

List of NSW first home buyer grants

(Based on Scheme Type)

First Home Buyers Grant

What It Offers

$10.000 for new builds or substantially renovated homes

Key Limits

Property up to $600 k or land plus build up to $750 k

First Home Buyer Assistance Scheme

What It Offers

Pay no stamp duty up to $650 k, discounted duty to $800 k

Key Limits

New or existing homes and vacant land

First Home Guarantee

What It Offers

Buy with 5 per cent deposit, no LMI

Key Limits

Income limit $125k singles, $200k couples

Shared Equity Scheme

What It Offers

Government buys up to 40 per cent of your home

Key Limits

Income and asset caps apply

Withdraw up to $30.000 of super for your deposit

What It Offers

Withdraw up to $30.000 of super for your deposit

Key Limits

Must meet ATO release rules

Tools to Help You Decide

Not sure how much you can borrow or what costs to expect? Use our calculators to explore your options and feel more confident about your next step. They're simple, accurate, and free to use.

- EMI Calculator

- Helps estimate monthly mortgage repayments.

- Stamp Duty Calculator.

- Calculates stamp duty across Australian states including exemptions.

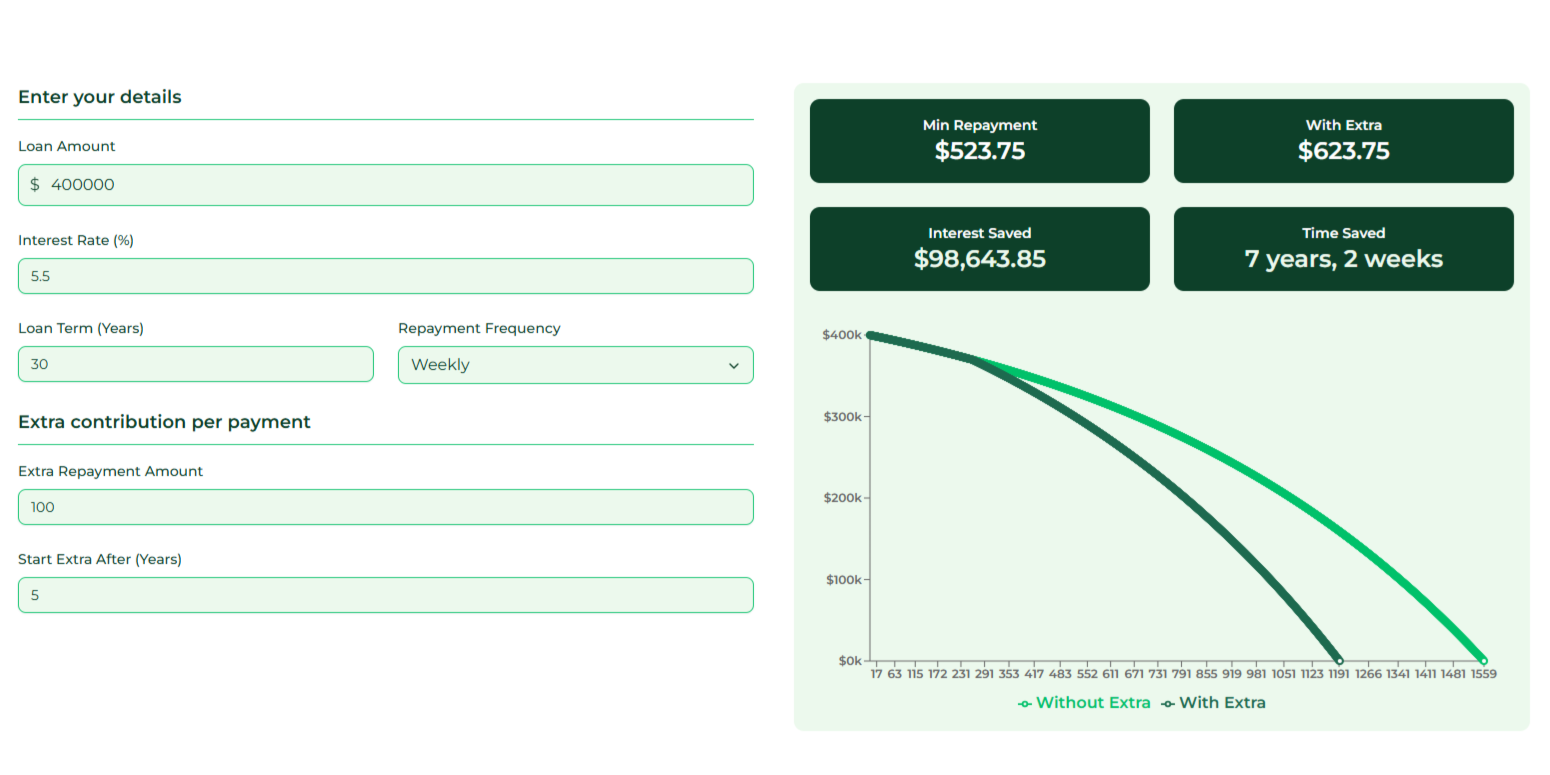

- Extra Repayment Calculator.

- Shows how extra repayments reduce loan term and interest.

Speak to a Local Home Loan Expert

Stryve brokers have guided hundreds of NSW buyers through grants, lender options and common pitfalls.

Clear advice on eligibility and schemes

Understand what you're eligible for and how to apply without the confusing paperwork.

Help using grants in your deposit

We’ll show you how to apply government incentives toward your home loan deposit.

No jargon, no fees, no pressure

Speak to real experts who explain things clearly — no obligations or surprise costs.

They made the grant process easy. I did not realise I qualified for more than one scheme” - Emily, builder, Wollongong 2025